How to Qualify for an FHA Loan with the Maximum Limit in Texas: Requirements and Criteria to Consider for Dummies

If you're a first-time homebuyer in Texas, you might be questioning how to certify for an FHA financing along with the maximum limit. An FHA loan is a mortgage loan insured through the Federal Housing Administration (FHA), which produces it much easier for borrowers to acquire financing also if they have less-than-perfect credit scores. In this post, we'll cover the demands and criteria you need to consider when using for an FHA funding along with the the greatest restriction in Texas.

What is an FHA Loan?

An FHA loan is a mortgage that's insured by the Federal Housing Administration. The FHA doesn't create financings itself but rather insures home loans produced by authorized lenders. fha loan amounts texas lenders versus reductions if borrowers skip on their fundings.

One of the largest advantages of an FHA car loan is that it allows debtors to produce a smaller down payment than they would need to have along with a conventional mortgage. For instance, along with an FHA lending, you may put down as little bit of as 3.5% of the acquisition price. In enhancement, credit score requirements are commonly even more lenient than along with conventional car loans.

How to Certify for an FHA Loan

To qualify for an FHA financing in Texas, you should meet particular eligibility requirements:

1. Minimum Credit Score

The minimum credit history rating required for an FHA funding in Texas is 580 or greater. If your rating falls below this threshold, you might still be able to train but will definitely require to put down a much larger down remittance.

2. Maximum Loan Limit

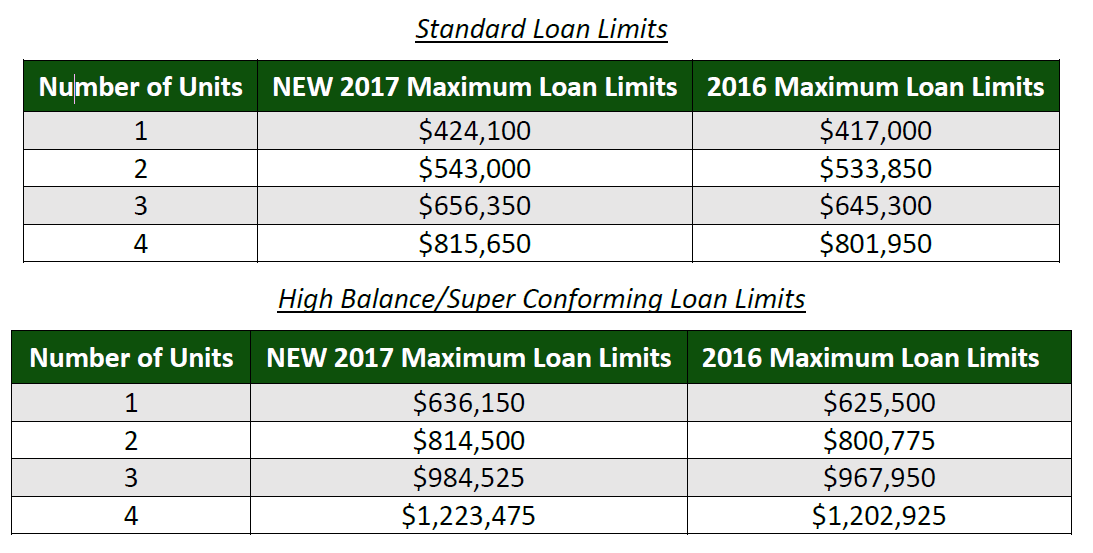

The maximum volume you may obtain with an FHA car loan depends on where you live and varies coming from $356,362 up to $822,375 in high-cost areas like Austin and Dallas-Fort Worth.

3. Debt-to-Income (DTI) Proportion

Your debt-to-income ratio (DTI) gauges your monthly personal debt settlements matched up to your disgusting month-to-month profit prior to tax obligations and other reductions are taken out. The maximum DTI proportion permitted under current tips is 43%, although some loan providers may deliver much higher proportions for customers along with solid credit scores and various other compensating factors.

4. Employment and Income Verification

FHA lenders will definitely call for verification of income and work to make sure that you possess a dependable resource of profit to support the mortgage loan settlements. You'll require to supply pay stubs, W-2s, tax obligation profits, and other information to validate your work and revenue.

5. Property Appraisal

An FHA-approved evaluator are going to evaluate the building you're obtaining to ensure that it meets minimum property standards. This assessment assists make certain that the house is risk-free, protected, and structurally sound.

6. Mortgage Insurance Premium (MIP)

FHA finances require home loan insurance policy superiors (MIP) upfront at closing as well as each year for the lifestyle of the funding. The upfront MIP fee is presently 1.75% of the lending quantity, while the annual MIP fee ranges from 0.45% to 1.05%, relying on your down remittance quantity and funding condition.

7. Residency Criteria

To train for an FHA car loan in Texas, you need to be a legal resident of the United States with a legitimate Social Security variety or Alien Registration Number.

Criteria to Look at When Administering for an FHA Loan with Maximum Limit

Here are some added standards you ought to think about when applying for an FHA finance with maximum limitation:

1. Credit Score Improvement

If your credit rating score is below 580, think about taking steps to boost it prior to administering for an FHA lending in Texas. This can easily feature paying for off impressive financial debts, disputing errors on your credit file, or working along with a credit counselor or financial expert to build a strategy for enhancing your rating over opportunity.

2. Loan Term Length

Look at whether a shorter or longer funding phrase would be finest for your monetary condition when applying for an FHA finance in Texas with maximum limit.

3. Interest Rates Comparison

Match up passion fees coming from a number of creditors prior to opting for one to work along with. This will certainly help you obtain the greatest achievable rate and conserve loan over the life of your funding.

4. Pre-Approval

Get pre-approved for an FHA financing prior to shopping for a house in Texas. This will give you a better concept of how a lot residence you may pay for and assist you help make extra informed decisions during the homebuying method.

Final thought

Training for an FHA funding along with maximum limitation in Texas calls for meeting certain qualifications criteria, consisting of a minimal credit rating credit rating, the greatest car loan limitation, debt-to-income proportion, job and earnings confirmation, residential or commercial property assessment, mortgage loan insurance premium (MIP), post degree residency demand. Furthermore, think about standards such as credit score credit rating enhancement, car loan phrase duration, rate of interest prices evaluation and pre-approval to ensure that you're receiving the finest achievable offer on your mortgage. Along with these tips in thoughts, you can easily create informed decisions regarding your homebuying journey and attain your aspiration of homeownership in Texas.